Что такое unsettled cash

What does “Unsettled Cash” mean on Revolut?

If you have ever traded stocks on Revolut, then it is likely that you have come across the term “Unsettled cash” at some point in time.

In short, “Unsettled cash” is money that you are due to receive after selling a stock. However, you will be unable to withdraw this money until the sale is 100% complete.

If you go into the “Available to invest” section on Revolut, you will be shown the following screen:

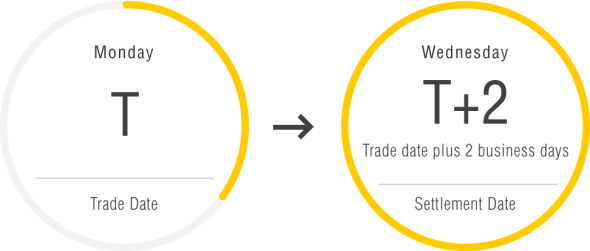

Although you can instantly sell shares at the click of a button, the process behind the sale actually takes a couple of business days.

This is called the “Settlement Period”. For example, in the USA, the “Settlement Period” lasts for two business days after the day of the sale. This a rule set that is set down by the SEC. It is not something that Revolut came up with themselves.

The Revolut app offers up the following explanation:

The proceeds from sell trades that haven’t settled yet. You can reinvest these funds right away, otherwise this will be available to withdraw once settled.

In other words, this money is pending until the person who purchased your stock becomes the new owner of it.

How long does it take for unsettled cash to become available for withdrawal on Revolut?

Typically speaking, it will take between 4-5 business days before your unsettled cash becomes available to withdraw on Revolut. This includes the day that you sold your shares.

The Settlement Period on US stocks is two business days starting after the day of the sale. For example, if you sold your stocks on Monday, then the Settlement Period won’t end until after Wednesday. This is also known as “T+2”.

However, this doesn’t necessarily mean that you will be able to withdraw the cash on Wednesday. Judging from my own experience, it could be Thursday or Friday before Revolut actually makes your cash available to withdraw.

This is one of the reasons why you should never invest money that you might need in the immediate future. Investing in the stock market is a long-term process. It is likely that you will lose money if you try and use it as a short-term savings account. As a result, you should only ever invest money that you won’t need to touch for the foreseeable future.

О режиме T+2 при работе с брокером и проблеме Free riding

При работе с тем или иным брокером важно знать, какой режим торгов (расчетов) он использует. Под режимом расчетов понимается процедура фактического списания денег со счета покупателя в пользу продавца и перевода бумаг с депозитарного счета продавца на депозитарный счет покупателя.

Таких режимов может быть три: Т0, Т+1 и Т+2. В режиме Т0 расчеты производятся по завершении торгового дня, в режиме Т+1 – по завершении следующего торгового дня, в режиме Т+2 – через один торговый день.

Чаще всего вы будете встречаться с режимом Т+2. Именно он используется при операциях с акциями и биржевыми фондами ETF. И вот, что вам следует о нем знать при работе через Interactive Brokers.

Как работает Т+2 в Interactive Brokers?

В Interactive Brokers есть два основных типа счета – маржинальный (Margin account) и денежный (Сash account). Если вы торгуете на маржинальном счете, то режим Т+2 вам не особенно важен. Потому как для закрытия временного разрыва и урегулирования сделки (т.н. Settlement) привлекаются средства брокера. В случае же с денежным счетом дело обстоит иначе. Здесь нужно учитывать режим торгов Т+2 для планирования своих сделок.

При продаже бумаг на денежном счете в рамках режима Т+2 деньги должны поступить на счет в течение двух торговых дней (именно торговых, выходные – не в счет). И если у вас нет свободных наличных на счете, то совершить покупку новых бумаг вы сможете только когда средства от продажи будут доступны на счете.

Другая потенциальная проблема, с которой вы можете столкнуться, – “заморозка” счета на 90 дней. Это может случиться, когда вы покупаете акции, а затем продаете те же акции до получения денежных средств (то есть ранее, чем после прохождения двух дней). В таком случае вы можете получить предупреждение от брокера о нарушении регламента T (The Federal Reserve Board’s Regulation T) и принципа Free riding. Ниже выдержки из Википедии, поясняющие эти моменты.

Regulation T и Free riding

Говоря проще, если вы нарушили правила фрирайда, но имеете дополнительные средства на счете, то сможете торговать в рамках имеющихся денежных средств. Однако лучше не нарушать данный режим, так как при повторном нарушении заморозка счета в том же IB может составить 180 дней.

What Is Unsettled Cash On E*Trade?

Online trading and investment have continued to grow over the years as platforms like ETrade have emerged. As an investor or an online business enthusiast, it is essential to understand certain terms used on investment platforms. Speaking of terms, you must have come across “unsettled cash” on ETrade.

Unsettled cash is the amount you earned through the sale of an investment. You cannot withdraw your unsettled cash until the settlement procedure is completed. Therefore, when you sell out an asset on ETrade, the money you receive from the sale requires a settlement period of 5 business days – Saturdays, Sundays, and weekends excluded – before it appears as available cash in your account.

In this article, we’ll take a look at the concept of unsettled cash on ETrade, what you can do with it, and when to use it. I will also shed more light on what happens during the settlement period.

When is an investment sale considered unsettled?

After selling an investment, say, stock, you will receive an amount from that trade. The amount received from the moment the transaction is complete until it shows as “cash available to withdraw” is known as unsettled cash or unsettled fund. Throughout this period, the investment sale is unsettled.

You can then withdraw the money earned into your bank account after settlement.

The unsettled cash concept is similar to, but not quite the same as the third-party Escrow. With Escrow, both parties do not receive their assets until the transaction is deemed successful. Also, Escrowed transactions take a shorter period, generally within 24 hours.

FYI: The best way I’ve found to invest in ETFs is through M1 Finance. It’s free and you even get an instant line of credit! Have a look here (link to M1 Finance).

How long does it take for money to be available to withdraw on ETrade?

It takes three days to withdraw money after selling an investment since the Securities and Exchange Commission (SEC) has to clear the transaction. On ETrade, however, it takes longer – 5 days to release cash for withdrawal.

The SEC holds regulations on how long a stock transaction takes to become official. The present protocols require a three-day settlement for the cash from stock sales to be made accessible. So, you should expect at least three days from the moment you sell out stock to gain access to the money.

If you expect at least three days for settlement, then there is room for an extension of up to five days. ETrade transactions processes are slow, hence the 5-day settlement period.

NOTE: The easiest way to add diversification to your portfolio is to invest in real estate through Fundrise. You can become private real estate investor without the burden of property management! Check it out here (link to Fundrise).

When to use unsettled funds in a trading account on ETrade?

There are no limits on what you can purchase if your account has enough settled cash. In addition, whatever security you obtain using settled funds has no time constraints regulating when you can sell it. But there are restrictions with unsettled funds on ETrade.

You can use unsettled funds to buy more securities only if you do not sell the newly acquired security before the settlement of the original sale that generated the funds needed to finance the new purchase. If you sell the new security before the financing sale’s settlement date, it will be declared a Good Faith Violation.

You can purchase assets with unsettled funds as long as you allow them to settle before selling. The “Unsettled” is simply a heads-up that the money hasn’t been resolved yet.

Conclusion

For every investment you sell on ETrade, you receive unsettled cash. It takes a settlement period of 5 days to gain access to the money and withdraw it.

While you can use unsettled cash to buy stocks, it might lead to a breach of SEC regulations if you are not careful. Therefore, it is advisable to wait the five days required for the funds to be available to withdraw before making further transactions.

Over the past years, I have discovered several tools and products that have helped me tremendously on my path to financial freedom:

P.S.: The links below are affiliate links, which means I receive a small commission at no extra cost to you when you sign up for one of the services. Thank you for your support!

1) Take a look at M1 Finance, my favorite broker. I love how easy it is to invest and maintain my portfolio with them. I can set up automatic transfers, rebalance my portfolio with one click and even borrow up to 35% of my assets at super low interest rates!

2) Fundrise is by far the best way I’ve found to invest in Real Estate. You can diversify your portfolio by investing in their eREITs or even allocate capital to individual properties (without the hassle of managing tenants!).

3) If you are interested in crypto, check out Gemini. I’ve started allocating a small amount of assets to the growing crypto space and Gemini has just been a breeze to use. Once you register, make sure to also open an Active Trader account to buy crypto at the lowest fees on the market (just 0.03%!).

To see all of my most up-to-date recommendations, check out the Recommended Tools section.

Hi! My name is Marvin. I am on a path toward financial freedom. On this blog, I share thoughts and ideas on Personal Finance & Investing.

I started this blog because I believe that money is just a means to an end: to be free to spend your time as you wish, to maximize your positive impact on the world.

My current investment strategy involves investing most of my capital in Vanguard funds through M1 Finance. I use the dividends (plus their ‘borrow’ option) to invest in real estate deals with Fundrise. Finally, I invest the real estate distributions into various crypto assets using Gemini.

Click here to learn more about my personal investment strategy for financial freedom.

Как торговать внутри дня на маленьком счете в Interactive Brokers?

Если вы нарушите это правило и совершите четвертую сделку в рамках 5-дневного периода, то попадете под блокировку по статусу внутридневной трейдер, известную как Pattern Day Trader (PDT).

Дневной трейдер с точки зрения FINRA и NYSE – это трейдер, который совершает 4 и более дневные сделки (открытие и закрытие в тот же день акции или опциона на акции) в течение 5 рабочих дней. (Фьючерсные контракты и опционы на фьючерсы в это правило не включены.) Подробнее здесь.

Очевидно, что это проблема для тех, кто хочет активно торговать в IB внутри дня и имеет небольшой счет. Есть пара хаков, как это ограничение обойти. Первый: открыть дополнительный маржинальный счет и тем самым увеличить количество доступных сделок. Второй: открыть дополнительный наличный счет и не подпадать под Pattern Day Trader (PDT). С первым способом, думаю, все понятно. Поэтому остановлюсь на втором.

Торговля внутри дня на наличном счете в IB

В Interactive Brokers есть два типа счета: 1) маржинальный (Margin Account) и 2) наличный (Cash Account). На маржинальном счете вы получаете плечо (1:4) и возможность торговать в шорт. На наличном счете вы не можете торговать на деньги брокера и не можете открывать коротких позиций. Но на наличном счет нет статуса дневного трейдера (PDT). Количество сделок на нем не ограничено.

Только активы для торговли на данном счете должны быть разными и при работе нужно учитывать режим торгов при проведении расчетов по сделкам (по акциям он Т+2). В ином случае вы можете нарушить уже другое правило – Free riding (о нем я писала здесь). Для того чтобы его не нарушать, вам нужно торговать только в рамках свободных (урегулированных) денежных средств.

Контролировать доступные для торговли свободные средства можно в торговом терминале. В верхнем горизонтальном меню есть раздел Счет. В нем нужно выбрать Окно счета и в открывшемся списке найти строку Current Available Funds (Свободные средства на текущий момент). Указанная в ней сумма и есть ваш резерв для торговли.

В свою очередь контролировать режим торгов по сделкам и срок их урегулирования можно в отчете Подтверждение сделок. Скачать его можно в личном кабинете IB в разделе Отчеты. Из торгового терминала перейти на него можно так.

О режиме T+2 при работе с брокером и проблеме Free riding

При работе с тем или иным брокером важно знать, какой режим торгов (расчетов) он использует. Под режимом расчетов понимается процедура фактического списания денег со счета покупателя в пользу продавца и перевода бумаг с депозитарного счета продавца на депозитарный счет покупателя.

Таких режимов может быть три: Т0, Т+1 и Т+2. В режиме Т0 расчеты производятся по завершении торгового дня, в режиме Т+1 – по завершении следующего торгового дня, в режиме Т+2 – через один торговый день.

Чаще всего вы будете встречаться с режимом Т+2. Именно он используется при операциях с акциями и биржевыми фондами ETF. И вот, что вам следует о нем знать при работе через Interactive Brokers.

Как работает Т+2 в Interactive Brokers?

В Interactive Brokers есть два основных типа счета – маржинальный (Margin account) и денежный (Сash account). Если вы торгуете на маржинальном счете, то режим Т+2 вам не особенно важен. Потому как для закрытия временного разрыва и урегулирования сделки (т.н. Settlement) привлекаются средства брокера. В случае же с денежным счетом дело обстоит иначе. Здесь нужно учитывать режим торгов Т+2 для планирования своих сделок.

При продаже бумаг на денежном счете в рамках режима Т+2 деньги должны поступить на счет в течение двух торговых дней (именно торговых, выходные – не в счет). И если у вас нет свободных наличных на счете, то совершить покупку новых бумаг вы сможете только когда средства от продажи будут доступны на счете.

Другая потенциальная проблема, с которой вы можете столкнуться, – “заморозка” счета на 90 дней. Это может случиться, когда вы покупаете акции, а затем продаете те же акции до получения денежных средств (то есть ранее, чем после прохождения двух дней). В таком случае вы можете получить предупреждение от брокера о нарушении регламента T (The Federal Reserve Board’s Regulation T) и принципа Free riding. Ниже выдержки из Википедии, поясняющие эти моменты.

Regulation T и Free riding

What does Unsettled Cash mean?

✅ App ✅ Website ✅ Capitec Widget

Unsettled Cash is the cash you received from the sale of an investment on the platform. This cash cannot be withdrawn until it has gone through a settlement process.

When you sell out of an investment on the platform, it takes a period of 5 business days (the «Settlement period») for the cash proceeds of that sale to be settled and to show in your account as available funds.

This is in line with Johannesburg Stock Exchange’s rules which require a T+3 settlement period and our EasyEquities Terms and Conditions which make provision for a maximum of 5 business days for settlement.

Only after those funds have been settled, can they be withdrawn into your personal bank account.

The settlement period is 5 business (working) days. Saturdays, Sundays and public holidays are not considered business (working) days

Did you find it helpful? Yes No

© EasyEquities. EasyEquities is a product of First World Trader (Pty) Ltd t/a EasyEquities which is an authorized Financial Services Provider (FSP number 22588). All trades on the EasyEquities platform are subject to the legal terms and conditions to which you agree to be bound. The EasyEquities platform enables users to invest in securities which includes whole shares and fractional share rights (FSRs). EasyEquities acts as an agent for the issue of whole shares, where the investor is the registered owner of those shares, entitled to dividends, participation in corporate actions and all the economic benefits and risks associated with share ownership.

In respect of FSRs, EasyEquities acts as principal to a contract for difference issued to the investor, where the investor will have a contractual claim against EasyEquities to the economic benefits and risks associated with share ownership (price movements and dividends) without having ownership rights in the underlying share. Fractional share rights (FSRs) which are issued through a contract for difference, are an over the counter derivative. Unlike whole shares, FSRs do not carry any voting rights. As the investor makes further investments in FSRs and ultimately ends up with a whole share, the contract for difference is closed out and ownership whole share is delivered to the investor.

The availability of any share on the EasyEquities platform is based on various factors but is not an indication of value and does not mean that any share is an appropriate investment for you.

The availability of any share on the browse shares page does not necessarily indicate any contractual relationship between EasyEquities and the listed company, or the payment of fees for services. Brand Logos are owned by the respective companies and not by EasyEquities. The use of a company’s brand logo does not represent an endorsement of EasyEquities by the company, nor an endorsement of the company by EasyEquities, nor does it necessarily imply any contractual relationship. Further investment disclosures are available on the EasyEquities website.

* Note exchange prices are delayed in accordance with regional exchange rules. South African prices are delayed by 15 minutes; North American prices are delayed by 15 minutes; Australian prices are delayed by 20 minutes.

EasyEquities is a subsidiary of Purple Group Limited, a company listed on the JSE Limited (PPE)